will salt get repealed

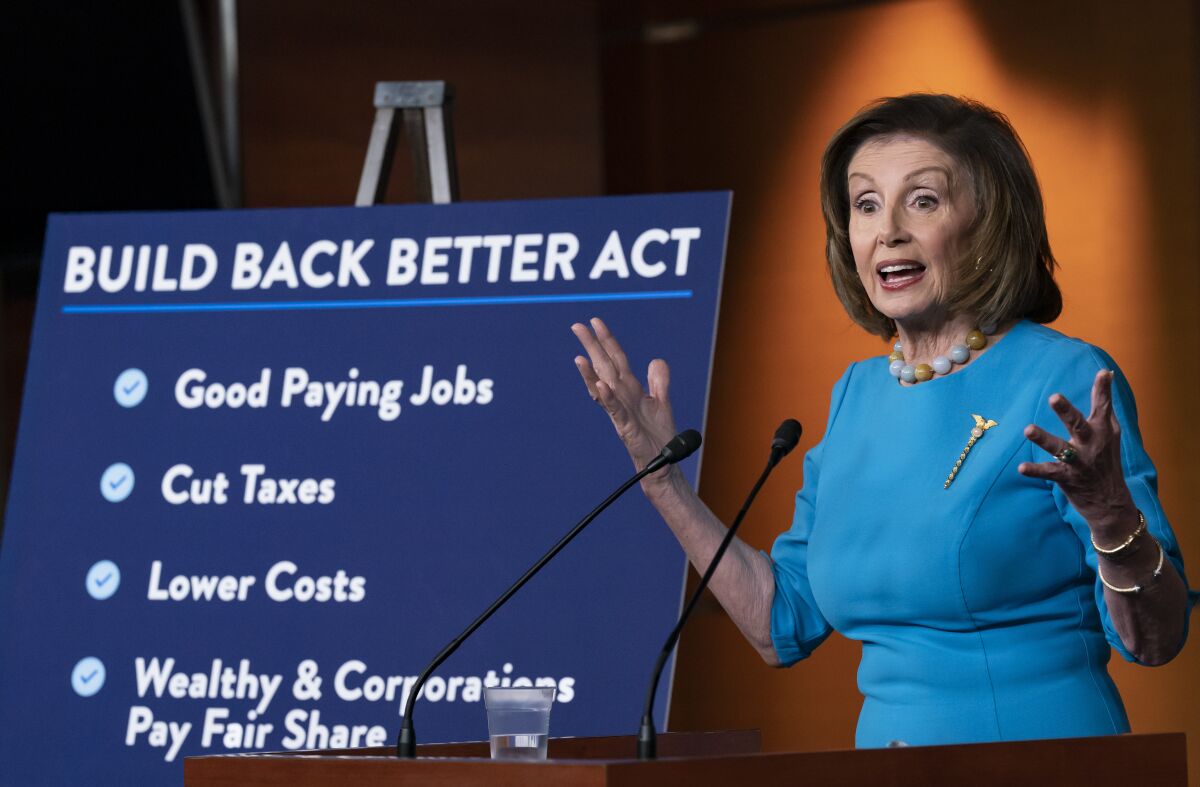

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the. Those earning between 250000.

Bill Schmick The Retired Investor Will Salt Be Repealed Columnists Berkshireeagle Com

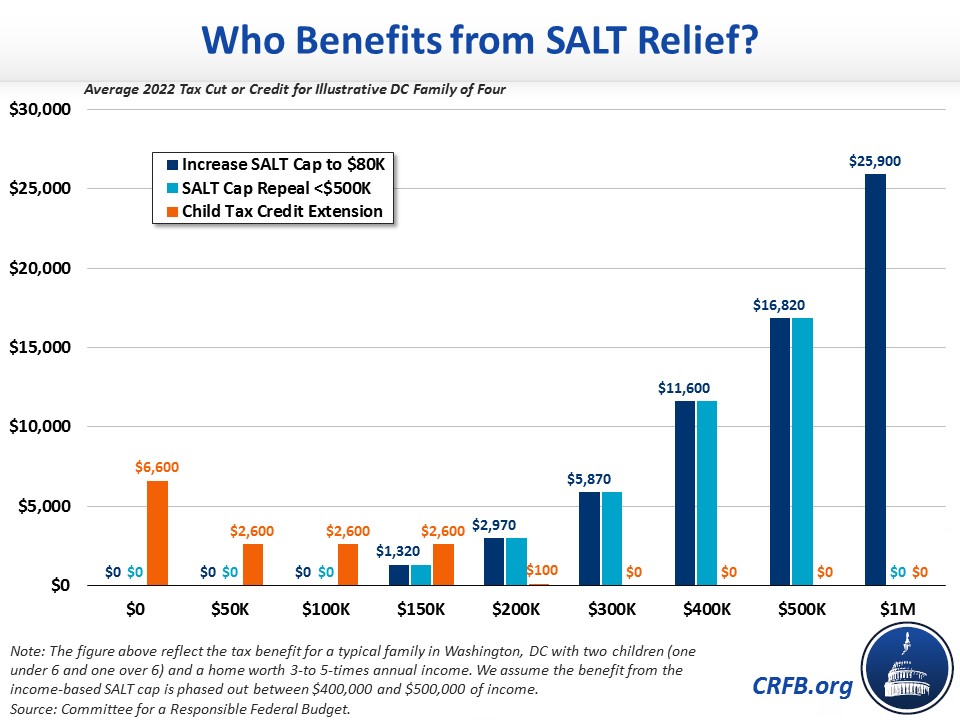

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000.

. If the SALT deduction cap is repealed and the prior-law AMT restored households earning over 1 million would be the biggest beneficiaries. The Tax Policy Center found that only 3 of middle-income households would pay. Joe Manchin D-WVa raised broader objections to President Bidens social spending and.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Biden did not include a SALT repeal in the framework that he unveiled last week but the White House has previously said its open to eliminating the deduction cap. On December 19 the US.

The lawmakers have asked the US. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut. Analyses found that repealing the cap would disproportionately benefit the wealthy.

With the Senate split evenly between both parties Democrats cannot. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. The SALT deduction benefits only a shrinking minority of taxpayers.

No SALT no deal they said. Department of the Treasury Secretary Janet Yellen and IRS Commissioner Charles Rettig to reverse a 2019 rule blocking a state-level SALT. SALT Cap Rollback for Two Years Debated by House Democrats Lawmakers consider using procedural move to advance repeal Ways and Means to finish writing tax.

House of Representatives advances legislation to suspend the 10000 cap placed on state and local tax SALT deductions for next two years. SALT could prove to be a major dividing point given that Democrats hold narrow control of Congress.

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Nancy Pelosi Privately Opposes Repeal Of Salt Deduction Cap

Wealthy Democrat Donors Likely To Benefit From Democrats Repeal Of Salt Cap Fox Business

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

As Dems Push Salt Cap Repeal Many States Have Ok D Workaround Fox Business

Lawmakers Offer Bill To Repeal Cap On Salt Deduction The Hill

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

Salt Deduction Would Expand Under Build Back Better Bill But Its Fate Is Uncertain

House Democrats Concede Line In Sand Over Ending Salt Cap Politico

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Rep Steel Joins Colleagues To Launch Bipartisan Salt Caucus Representative Michelle Steel

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Schumer House Democrats Make Formal Push To Repeal Salt Cap Bloomberg

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Blue State Democrats Demand Salt Relief In Biden S Next Big Bill Politico

Porter Backed Bill Seeks To Restore Salt Deductions Capped Under 2017 Tax Act Orange County Register