colorado solar tax credit 2019

In 2019 the General Assembly enacted Senate Bill 19-181. Talk to a local installer about the.

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

Holy Cross has a per-kilowatt kW rebate for its customers to reduce the cost of going solar.

. Dont Forget the Federal Tax Credit Colorado. A carve-out is that portion of a states renewable energy that must come specifically from solar. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online.

In the service territory of investor-owned utilities in Colorado. The federal solar tax credit along with state and local grants rebates and tax credits can add up to savings of more than 50 percent on a home photovoltaic system. To help you make sense of them this guide summarizes all the Colorado solar rebates available in 2019.

This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives. The percentage you can claim depends on when you installed the equipment. Colorado Spring Utilities offers an installation rebate of 010 per watt.

Colorado Department of Labor and Employment. But thats not all you can save. These are the solar rebates and solar tax credits currently available in Colorado according to the Database of State Incentives for Renewable Energy website.

DR 0347 - Child Care Expenses Tax Credit. And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22. Lots of sunlight state rebates property and sales tax exemptions plus the Federal Government 30 tax credit for the whole installed cost of your system are compelling reasons to go solar in Colorado.

Solar Tax Credits 101. Some states also offer tax exemptions for photovoltaic installations. Colorado has long been a leading state in the national initiative for solar power and renewable energy.

The federal tax credit for solar energy is generous. 12720 Approximate system cost in Colorado after the 26 ITC in 2021. Effective May 5 2014 through July 1 2019 all sales.

DR 0346 - Hunger Relief Food Contribution Credit. For example EnergySmart Colorado offers 400 3000 rebates depending on where you live. The green colorado credit reserve gccr is a loan loss reserve that was created by the colorado energy office ceo to incentivize private lenders in colorado to make small commercial loans up to 250000 for capital improvements that.

You do not need to login to Revenue Online to File a Return. Please note that this will decrease as more residential solar comes online so the longer you wait the more you will pay out of pocket. State tax expenditures include individual and corporate income tax credits deductions and exemptions and sales and use tax exemptions.

Installing renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Please consult your tax preparer.

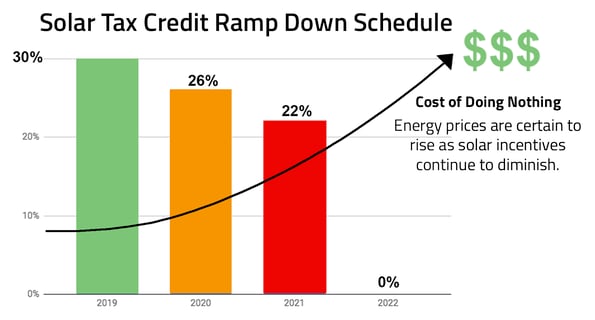

Colorado Solar Tax Credit 2019 - The residential itc drops to 22 in 2023 and ends in 2024. Xcel Energy offers rewards for small medium and large solar installs. If you want to make sure you get the full 30 tax credit dont wait we expect 2019 installation schedules to fill up quickly.

026 1 022 025 455. 6 Approximate average-sized 5-kilowatt kW system cost in Colorado. For an 18000 system the total cost.

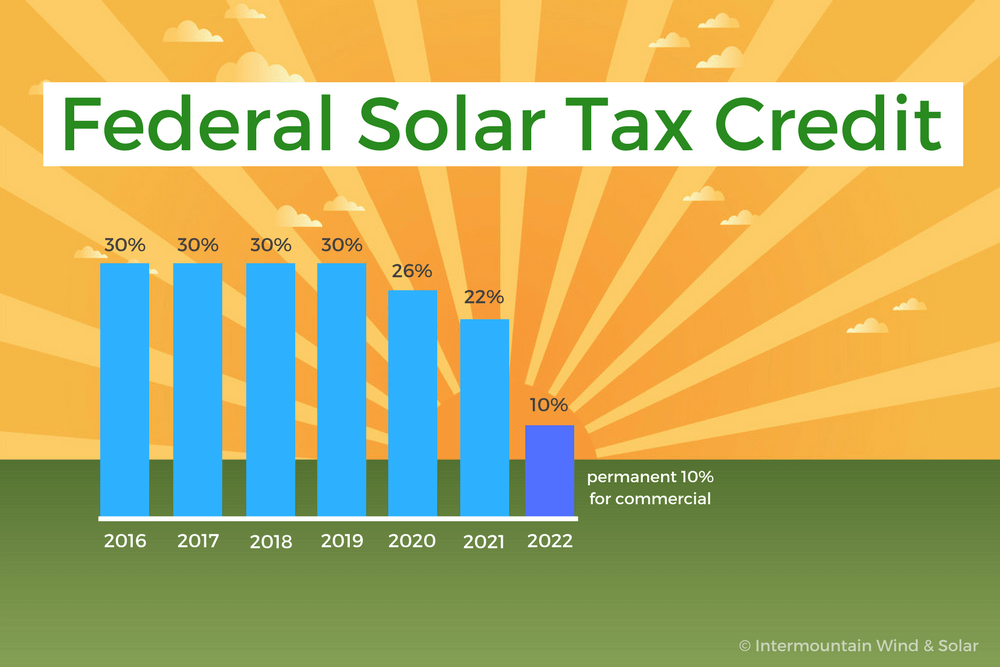

26 for equipment placed in service between 2020 and 2022. Colorado Solar Tax Credit Form. Colorado Solar Carve-Out.

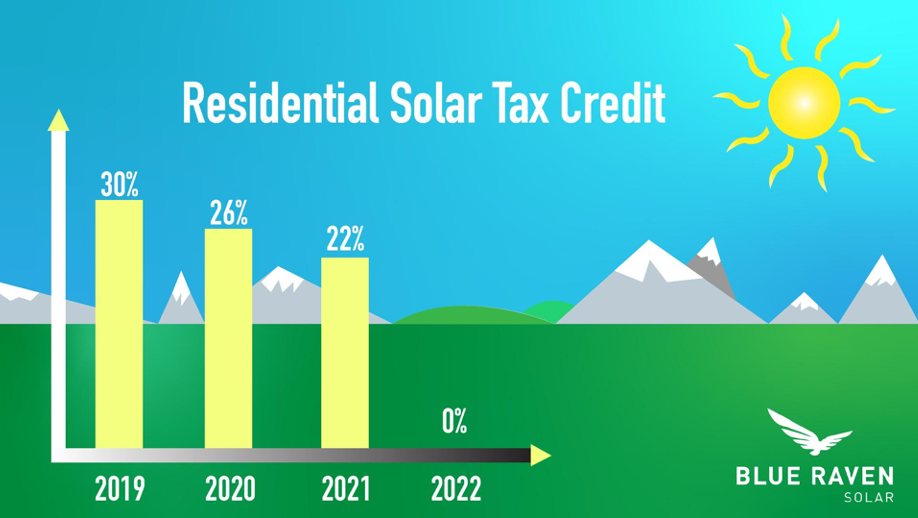

The residential ITC drops to 22 in 2023 and ends in 2024. In Colorado residential solar energy systems are eligible for both. Colorados Solar Friendly Communities is an offshoot of the national Sunshot Initiative that has resulted in several municipalities and county governments developing streamlined application and approval processes.

The first is that utility incentives must be accounted. Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit. DR 1316 - Colorado Source Capital Gain.

30 off system price through 2019. Summary of solar rebates available to Colorado residents. 303-318-8000 Give Us Website Feedback Customer Service Feedback Submit Claimant Feedback.

22 for equipment placed in service in 2023. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. DR 0366 - Rural Frontier Health Care Preceptor Credit.

On top of these great Colorado rebates and exemptions you also qualify for the sizable tax credit from the Federal. Note that because reducing state income taxes increases federal income taxes paid the two tax credits are not additive ie not 25 26 51. That 30 rate remained the same from 2006 through 2019.

Roaring Fork Valley and Crystal River Valley. Some Colorado utility companies may offer cash rebates for residential solar installations. DR 0350 - First-Time Home Buyer Savings Account Interest Deduction.

The credit for 30 of the installed cost runs through the end of 2019 in 2020 it decreases to 26 and in 2021 it decreases again to 22 before ending completely in 2022. 633 17th Street Suite 201 Denver CO 80202-3660 Phone. Tax savings will decrease as the principal is paid down.

To claim the. Currently this will equate to an extra 055watt which makes the total upfront solar rebate 255watt. 1003 enacted in 2019 increased the maximum size of a CSG.

With the coming reduction in the 30 tax credit 2019 is on pace to be a record setter for solar and we are already beginning to see an increase in demand here at Namasté Solar. The tax credit does not apply to solar water-heating property for swimming pools or hot tubs. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate to a residential or commercial property owner who installs a renewable energy fixture on his or her residential or commercial property.

30 for equipment placed in service between 2017 and 2019. Save time and file online. You may use the Departments free e-file service Revenue Online to file your state income tax.

Of course there are a couple of caveats. Rebates of anywhere from 400 to 2500 depending on where you live are available for solar installations on homes in Pitkin and Eagle counties Eagle Valley the Town of Vail and Summit County. 2019 is the Year to Go Solar.

In Colorado the carve-out was 3 by 2020. This is 26 off the entire cost of the system including equipment labor and permitting. DR 0375 - Credit for Employer Paid Leave of Absence for Live Organ Donation Affidavit.

The federal solar tax credit along with state and local grants rebates and tax credits can add up to savings of more than 50 percent on a home photovoltaic system.

These Three Companies Are Shaking Up The World Of Energy Paneles Solares Instalacion De Paneles Solares Energia Renovable

Federal Solar Tax Credit Guide Atlantic Key Energy

How Installing Solar Panels Can Help You Save On Your Taxes

Illinois Solar Panels 2019 Incentives

When Does The Federal Solar Tax Credit Expire Iws

Tata Power To Develop 100 Mw Solar Project At Raghanesda Solar Park In The Indian State Of Gujarat Solar Business Hub Solar Projects Solar Solar Companies

Solar Tax Credits And Rebates Grand Junction Colorado

Solar Tax Credit Details H R Block

How Does The Federal Solar Tax Credit Work Freedom Solar

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

How The Solar Tax Credit Makes Renewable Energy Affordable

Solar Tax Credits 2020 Blue Raven Solar

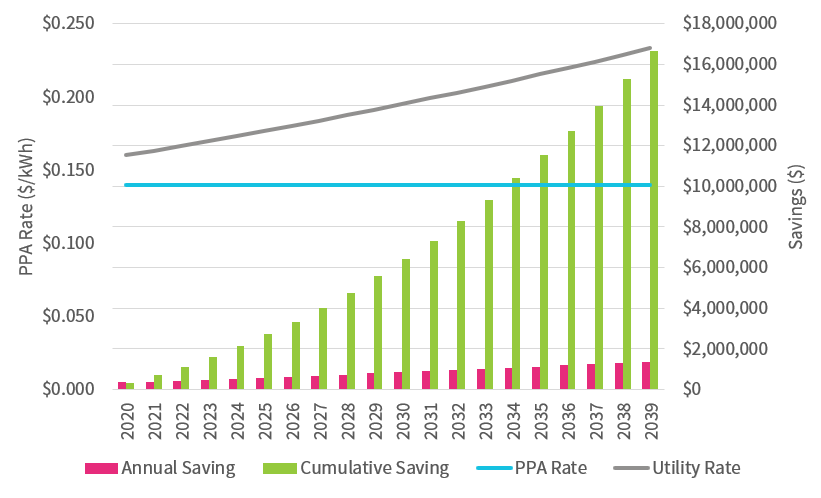

Time S Running Out Why Public Institutions Should Act Quickly To Maximize Solar Tax Credits Forefront Power

Tax Prep Checklist Family Binder Tax Prep Checklist Business Tax

Tennessee Solar Power If You Want To Know If Solar Makes Sense For Your Home Your Utility Your Bill Size Etc This Is Th Tax Credits Solar Loan Solar

Federal Solar Tax Credit How It Works Explained In Plain English Sun Source Homes

3 Solar Incentives To Take Advantage Of Before They Re Gone

Form 5695 Instructions Claiming The Solar Tax Credit Energysage